Understanding the Global Forces Shaping Gold Prices in 2025

Gold, often revered as a “safe-haven” asset and a timeless store of value, has demonstrated a remarkable performance in 2024 and continued its impressive rally into 2025, reaching unprecedented highs above $3,400 per ounce.

While daily price fluctuations might seem arbitrary, a complex interplay of global macroeconomic trends, geopolitical tensions, and shifting investment sentiment dictates gold’s trajectory. At Afriswiss Commodities Trading Ltd, Kenya, we closely monitor these forces to provide our clients with timely insights and help them navigate the dynamic precious metals market.

Let’s delve deeper to undestand the global forces that have been shaping gold prices over the past year and what to expect for the remainder of 2025.

Key Highlights

- Central banks are accumulating gold at record levels to reduce reliance on the US dollar and strengthen financial security.

- Geopolitical conflicts and global tensions are pushing investors toward gold as a reliable safe-haven asset.

- Shifting monetary policies, including interest rate cuts, are boosting gold’s appeal over low-yield alternatives like bonds.

- Gold is outperforming in multiple currencies, reflecting its growing role as a global hedge against currency volatility and inflation.

- Strong investment demand and constrained supply are reinforcing gold’s upward momentum, despite a slowdown in jewelry consumption.

1. Central Bank Buying Spree: The Unstoppable Demand

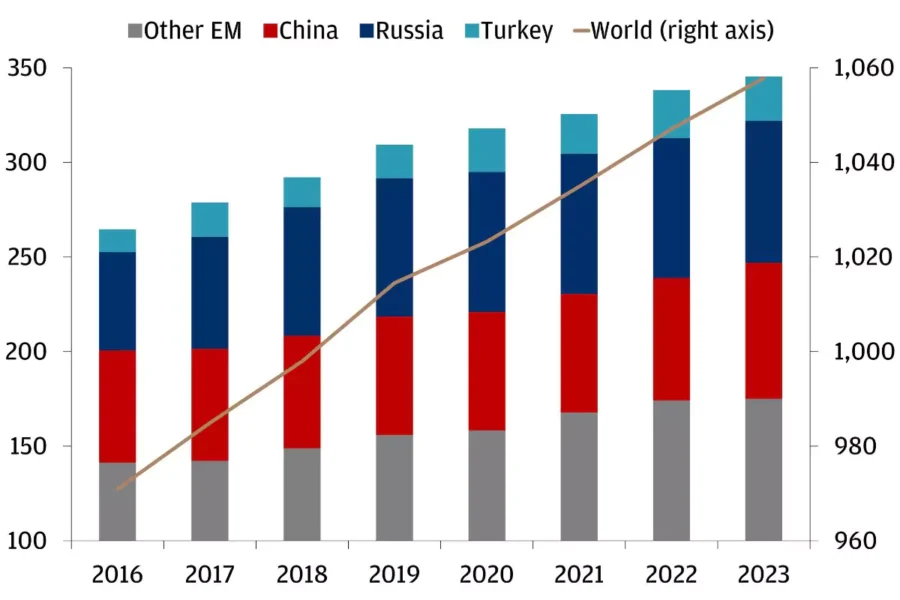

Perhaps the most significant and underappreciated factor driving gold’s ascent is the sustained, robust demand from central banks worldwide. For three consecutive years (2022-2024), official sector buying has exceeded 1,000 tonnes annually, a level not seen in five decades. This trend has continued strongly into 2025.

- Diversification from the US Dollar: A primary motivation for this accumulation is central banks’ desire to diversify their reserves away from the US dollar. Concerns about US financial sanctions and a broader shift towards a multi-polar global economic order are fueling this strategic move.

- Hedge Against Geopolitical Risk: Gold is increasingly being viewed as a critical hedge against geopolitical instability. Nations are bolstering their gold reserves to mitigate risks associated with escalating trade tensions, regional conflicts, and political uncertainty.

- Long-Term Store of Value: Central banks inherently value gold’s role as a long-term store of value and an inflation hedge, especially in an environment where inflation expectations remain a concern, even if cooling.

- Key Players: Countries like China (who resumed buying in late 2024), Poland, Turkey, and India have been among the largest gold accumulators.

This consistent and substantial institutional demand provides a strong fundamental floor for gold prices, making any significant downside less likely, even amidst other fluctuating factors.9

2. Geopolitical Tensions: The Ultimate Safe-Haven Play

The period spanning 2024 and 2025 has been marked by persistent geopolitical turbulence, which historically sends investors flocking to safe-haven assets like gold.

- Ongoing Conflicts: The protracted conflict in Ukraine and heightened tensions in the Middle East have contributed significantly to global uncertainty. These situations create a “risk-off” sentiment in markets, where investors seek assets perceived as secure.

- Trade Wars and Protectionism: Escalating trade tensions, particularly between the US and its major trading partners (including the imposition of tariffs),l markets. This creates a need for portfolio insurance, a role gold traditionally fulfills.

- Election Year Uncertainty: Significant elections in major economies also contribute to market jitters. The US presidential election in 2024, for instance, added a layer of economic uncertainty that pushed investors towards gold.

Gold’s ability to perform well during periods of stress underscores its enduring appeal as a crisis hedge, often overriding other traditional correlations.

3. Monetary Policy and Interest Rates: The Shifting Sands

Central bank monetary policies, especially those of the US Federal Reserve, wield considerable influence over gold prices. The interplay between interest rates, inflation, and the opportunity cost of holding non-yielding assets like gold is crucial.

- Interest Rate Expectations: After a period of aggressive rate hikes, central banks, including the Fed and the European Central Bank, have either paused or signaled potential easing (rate cuts) in 2025. Lower interest rates reduce the opportunity cost of holding gold, making it more attractive compared to yield-bearing assets like bonds.

- Inflation Outlook: While the direct correlation between inflation and gold can be complex, persistent inflation expectations (remaining above central bank targets in many economies) continue to support gold’s role as an inflation hedge. Investors look to gold to preserve purchasing power when fiat currencies are perceived to be eroding.

- Real Interest Rates: Gold’s price is often inversely correlated with “real interest rates” (nominal interest rates minus inflation). When real interest rates are low or negative, gold becomes more appealing as the returns from other assets diminish.

The shift towards potential rate cuts in 2025 has been a significant tailwind for gold, and any deviation from this path by central banks could introduce volatility.

4. US Dollar Strength and Currency Dynamics: A More Nuanced Relationship

Historically, gold and the US dollar have shared an inverse relationship: a stronger dollar makes gold more expensive for holders of other currencies, dampening demand, and vice versa. However, this correlation has become more complex in 2024-2025.

- Safe-Haven Demand Overrides: Despite periods of dollar strength, gold has continued its rally, particularly in 2024. This suggests that the overwhelming safe-haven demand driven by geopolitical and economic uncertainties has at times overridden the traditional inverse correlation with the dollar.

- Local Currency Impact: Gold’s rise has not been confined to USD; it has reached record highs in other major currencies like the British Pound and Euro, offering protection against currency volatility. In emerging markets with weaker currencies, the demand for gold as a store of value has surged, reflecting a waning faith in fiat currencies.

- De-dollarization Trend: The strategic diversification away from USD reserves by central banks, as mentioned earlier, is a multi-year trend that inherently provides support for gold and challenges the dollar’s long-term dominance.

While the dollar’s trajectory remains a factor, it is now one of several powerful forces, rather than the sole dominant influence, on gold prices.

5. Supply and Demand Fundamentals: Investment and Jewelry Shifts

Beyond the macroeconomic and geopolitical narratives, the underlying supply and demand dynamics also play a crucial role.

- Investment Demand: Investment demand for gold, including from ETFs and physical bar and coin buyers, has surged, reaching a four-year high in 2024 and continuing into 2025. Chinese and Indian investors, in particular, have shown robust interest.

- Jewelry Demand: Conversely, high gold prices have impacted jewelry demand, leading to a decline in volume in 2024, though the value spent on jewelry still increased. This suggests a shift in how consumers view and purchase gold.

- Mine Production & Recycling: Mine production has seen a modest increase, but recycling activity has declined as consumers hold onto their gold in anticipation of even higher prices. This indicates a relatively stable, albeit slow-to-respond, supply side.

The Outlook for the Remainder of 2025 and Beyond

As of mid-2025, the consensus among many analysts remains broadly bullish for gold. Forecasts suggest gold could trade in the $3,100-$3,500/oz range, with some optimistic projections even eyeing $4,000/oz under certain conditions like stagflation or accelerated de-dollarization.

For clients of Afriswiss Commodities Trading Ltd, understanding these global forces is vital. Kenya’s position as a hub for East African artisanal mining and a growing market for precious metals means that local prices will inevitably be influenced by these international trends, alongside local supply-demand dynamics and currency fluctuations.

The factors that propelled gold to record highs in 2024-2025 – namely robust central bank buying, persistent geopolitical uncertainty, and evolving monetary policy expectations – are likely to remain dominant themes. Gold continues to reassert its role as an indispensable asset in diversified portfolios, offering a hedge against risk and a store of value in an increasingly complex global landscape.

At Afriswiss, we provide the expertise and the infrastructure to help you navigate this market, whether you are an artisanal miner seeking fair value, a jeweler needing reliable supply, or an investor looking to secure your assets.

Stay informed and make strategic decisions in the precious metals market. Contact Afriswiss Commodities Trading Ltd today for expert insights and unparalleled service.