Which PGM Offers the Best Opportunity?

Platinum vs. Palladium in 2025

In the ever-evolving world of precious metals, platinum and palladium, both part of the platinum group metals (PGMs), continue to battle for dominance in 2025. These two metals have long been prized for their exceptional catalytic properties, durability, and resistance to corrosion. They are essential in the production of automotive catalytic converters, where they help reduce harmful emissions from vehicles.

Despite their similar roles in industrial applications, the market dynamics and investment outlook for platinum and palladium have diverged sharply this year. The forces shaping each metal’s performance include shifting automotive trends, particularly the global transition to electric vehicles (EVs), geopolitical tensions, technological innovations, and growing demand in the green hydrogen economy.

This divergence raises a timely and important question: Which PGM offers the best opportunity?

While palladium once reigned supreme due to its dominance in gasoline engine vehicles, platinum is now regaining investor favor, thanks to supply deficits, price competitiveness, and emerging use cases in renewable energy technologies. As a result, 2025 presents a unique moment for investors and analysts to reconsider their positions on these critical metals.

Key Highlights

- Both platinum and palladium are vital PGMs, but their investment outlooks have split in 2025.

- While palladium is in decline, platinum is gaining traction as the more strategic metal.

- Supply deficit continues due to mine closures in South Africa.

- Industrial demand is surging especially in hydrogen electrolyzers and fuel cell EVs.

- Jewelry demand rebounds in China and India, driven by affordability and style.

- Automakers are substituting expensive palladium with platinum in catalysts. EV adoption reduces demand for catalytic converters hurting palladium most.

- Russia remains a critical (but unstable) palladium source.

Market Performance Snapshot

| Metal | 2024 Avg Price (USD/oz) | 2025 YTD Trend | Supply Status | Key Demand Driver |

|---|---|---|---|---|

| Platinum | $970 | Bullish +22% | Deficit expected | Hydrogen fuel cells, jewelry |

| Palladium | $1,300 | Bearish –15% | Oversupplied | Internal combustion vehicles |

What’s Driving Platinum in 2025?

Platinum is gaining serious attention thanks to:

- A growing deficit due to mine closures in South Africa.

- Strong industrial demand, especially in green hydrogen tech and electrolyzers.

- Jewelry demand rebounding in India and China.

- Substitution of palladium with platinum in gasoline engine catalysts to cut costs.

Platinum is gaining serious attention in 2025 as multiple demand and supply-side factors converge to create one of the strongest outlooks for the metal in recent years. After several years of stagnation, platinum is now positioned as a strategic metal, not only for industrial use but also as a critical piece of the global transition to cleaner energy.

One of the most pressing drivers is a growing supply deficit, largely stemming from mine closures and operational challenges in South Africa, which remains the world’s largest producer of platinum. Years of underinvestment, aging infrastructure, and persistent power outages have hampered output. As production drops, available above-ground inventories are being rapidly drawn down, tightening the market.

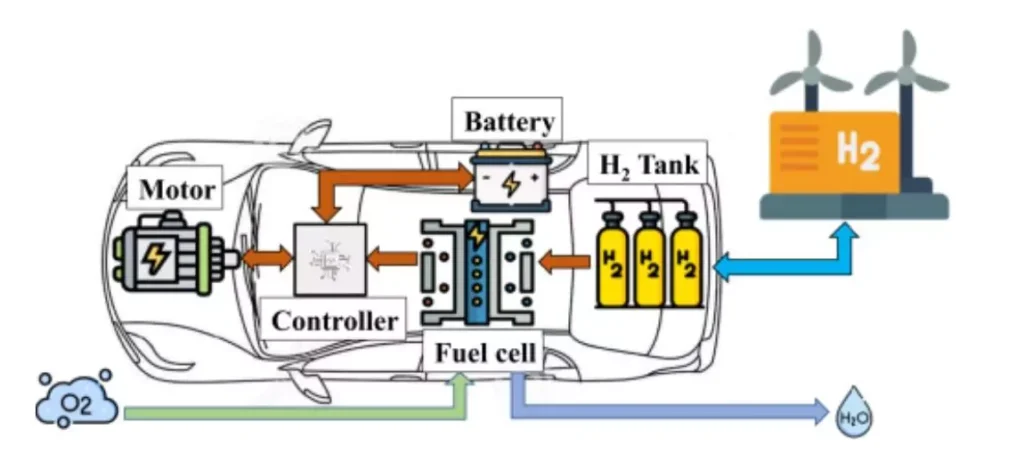

On the demand side, industrial consumption is booming, especially due to platinum’s essential role in green hydrogen technologies. As countries like Germany, Japan, and South Korea ramp up investments in hydrogen as a clean fuel alternative, platinum is increasingly being used in electrolyzers (devices that split water into hydrogen and oxygen) and in fuel cells that power next-generation electric vehicles and heavy-duty transport.

Meanwhile, platinum jewelry demand is staging a comeback, particularly in India and China, where younger consumers are gravitating toward platinum for its modern aesthetic and premium appeal. This shift is being bolstered by aggressive marketing campaigns and shifting cultural preferences that view platinum as a symbol of innovation and status.

Another major trend supporting platinum’s rise is the substitution of palladium with platinum in automotive catalytic converters for gasoline engines. With palladium prices having remained elevated for years, automakers are now switching to platinum as a cost-saving strategy without compromising performance.

Real-life example

Automakers like Toyota and Hyundai are actively investing in fuel cell electric vehicle (FCEV) technology, which relies heavily on platinum catalysts. Toyota’s latest generation of Mirai and Hyundai’s NEXO FCEV models both feature increased platinum loading, reinforcing the metal’s relevance in clean mobility.

Taken together, these factors suggest that platinum is not just riding a speculative wave, its resurgence in 2025 is rooted in real, structural shifts that position it as a cornerstone of both industrial and green innovation.

Why Palladium Is Losing Its Shine

Palladium’s story is more complex:

- Demand is shrinking as EV adoption grows, reducing internal combustion engine output.

- Automakers are switching to cheaper platinum alternatives in catalytic converters.

- Russia remains geopolitically unstable, but stockpiles have softened the blow.

Once the darling of the platinum group metals, palladium is now facing a period of significant decline in both demand and investor sentiment. After years of record-high prices driven by a supply squeeze and surging demand from the automotive sector, 2025 has brought a stark reversal in fortunes.

One of the biggest pressures on palladium is the global acceleration of electric vehicle (EV) adoption. Battery electric vehicles (BEVs) do not use catalytic converters, which is where palladium was most heavily used, in gasoline engine vehicles. As more countries push toward zero-emissions targets, traditional internal combustion engine (ICE) car production is shrinking. In markets like Europe and China, BEVs are expected to exceed 45–50% of new vehicle sales by 2026, a trend that spells long-term trouble for palladium.

Additionally, automakers are actively substituting palladium with cheaper platinum in gasoline engine catalytic converters. This trend began as palladium prices surged to all-time highs in 2021–2022, making it unsustainable for large-scale production. According to Johnson Matthey’s PGM Market Report, this substitution could account for the displacement of over 1 million ounces of palladium annually starting in 2024, significantly eroding demand.

Geopolitical factors further complicate palladium’s outlook. Russia, which supplies over 40% of the world’s mined palladium, remains a major player in global markets. However, sanctions, logistical challenges, and financial restrictions due to its ongoing war in Ukraine have made its supply more unpredictable. Still, a well-stocked chain of commercial and strategic inventories, especially in China and Switzerland, has prevented a major supply shock for now.

Despite the inherent supply risk tied to geopolitical tensions, palladium’s long-term fundamentals appear weaker unless new industrial uses emerge. With limited applications outside the auto industry and few breakthroughs in palladium-specific technologies, the metal lacks a clear growth engine for the future.

Despite its supply risks, palladium faces long-term headwinds unless a new industrial use emerges.

Unless a new industrial or technological breakthrough revives interest, palladium risks being left behind in the clean tech revolution, overshadowed by the growing versatility and green credentials of platinum.

Verdict: Platinum Has the Edge in 2025

For investors and industrial users alike, platinum is the better opportunity in 2025. It benefits from both scarcity and a greener future. Palladium still has niche value, but the winds are clearly shifting.

As the global economy accelerates its transition toward clean energy and sustainable technologies, platinum’s alignment with hydrogen fuel cells, electrolysis, and EV innovations gives it a strategic edge. Its growing relevance across sectors, from automotive to energy, positions it not just as a precious metal, but as a foundational material in the green revolution. Investors looking ahead would be wise to consider platinum not just as an alternative to palladium, but as a long-term play on the future of decarbonization.

Looking ahead, platinum isn’t just a precious metal, it’s a pillar of the clean energy transition.

Bonus Tip: Keep an eye on PGM recycling trends. With palladium prices falling, recycling margins are tightening, while platinum recyclers may benefit from tighter supply and rising demand.

AfriSwiss Commodities Trading Limited connects companies and investors to verified sources of platinum group metals, whether it’s platinum, palladium, rhodium, or others, by providing secure, transparent, and end-to-end sourcing solutions across Africa.

Ready to invest in the future of platinum group metals? Partner with AfriSwiss today and gain trusted access to verified PGM suppliers across Africa, secure, transparent, and tailored to your needs. Let’s power your portfolio with the metals that drive tomorrow.